Delivering a mortgage inside the Asia is fairly easy however it is a costly affair. However, there was a silver liner so you can they, which will be different income tax advantages you can get most of the season on it, according to the provisions of the Income tax Operate, away from 1961. It Act contains individuals parts around and therefore additional home loan tax professionals try provisioned getting home loan consumers so you can avail.

Property loan features several factors: installment of your principal sum therefore the interest costs. Fortunately, these be eligible for income tax deductions. While principal installment is actually deductible around Section 80C, deduction to your appeal fee was invited around Point 24(b) of one’s Taxation Operate, 1961. Continue reading understand how exactly to acquire the attention into the housing loan deduction to possess ay 2023-24.

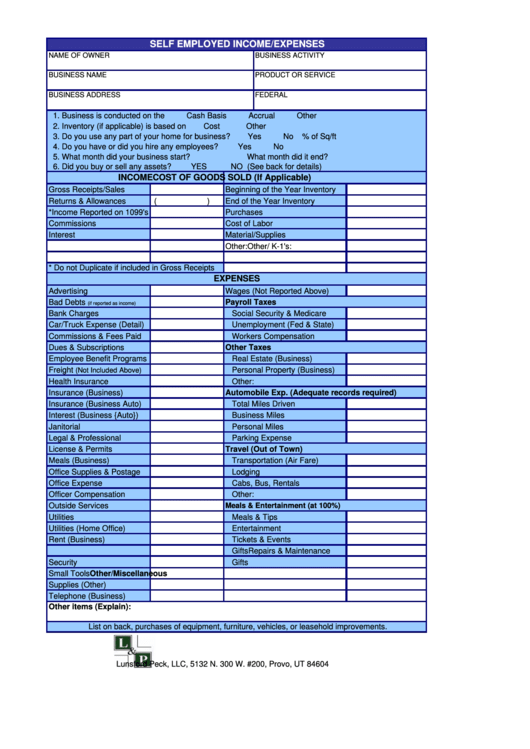

Tax Positives on the Mortgage brokers

The following desk shows new annual income tax positives according to the various other parts of the money Taxation Work, from 1961, reflecting your house financing appeal income tax deduction and you will property loan desire exclusion.

Which loan must be sanctioned (birth 01.4.2016 and you may finish 30.step three.2017). The loan number try lower than otherwise equal to ?thirty-five lakh together with value of assets will not exceed Rs. ?50 lakh.

Section 80C: Income tax Professionals with the Installment of the property Financing Principal Count

A mortgage borrower is permitted to allege tax experts right up so you’re able to ?step one,fifty,000 to the dominant payment from their/their unique taxable earnings, each year. That it loan places East Village work for are stated for rental and you may worry about-occupied features.

- In order to allege work with lower than it section, the property in which the loan has been borrowed might be completely founded.

- Even more income tax advantage of ?step 1,fifty,000 normally advertised not as much as it part getting stamp responsibility and you may membership costs; although not, it may be reported only if, we.elizabeth., in the course of these types of costs obtain.

- A good deduction claim cannot be made in the event the same property is marketed within 5 years regarding possession.

- In cases like this, people said deduction are going to be reversed in the year out of product sales. Concurrently, it sum could be within the individuals earnings towards the season, where property is sold.

Under Part 24(b), a good taxpayer can also be claim a deduction with the desire paid down to your our house mortgage. In such a case,

- You can claim a great deduction to the attention paid back toward home mortgage for a personal-occupied household. The maximum tax deduction greet is perfectly up to up to ?dos,00,000 in the terrible yearly money.

- However if one has a couple of homes, up coming if so, the joint income tax allege deduction to own lenders don’t meet or exceed ?2,00,000 in the a monetary season.

- If for example the family could have been rented out, then there is no restriction about how far one can allege for the attract paid down. This consists of the entire level of attract repaid on family mortgage with the purchase, construction/reconstruction, and you will revival otherwise fix.

- In the eventuality of losses, you can claim an effective deduction off merely ?2,00,000 in the a financial 12 months, once the remaining claim will be sent pass getting a tenure regarding eight years.

Lower than Part 24(b), an individual may plus claim an effective deduction towards the interest rate whether your property ordered is around structure, while the framework is accomplished. It area of the Act lets states on both pre-structure and article-build months appeal.

Area 80EE: Even more Deductions towards Attract

- So it deduction would be claimed on condition that the expense of the house gotten cannot meet or exceed ?fifty lakh therefore the amount borrowed is up to ?35 lacs.

Deja un comentario