It’s a great homeowner’s dream to manage to get their brand new house just before offering their latest property. Whatsoever, who would not plunge on possible opportunity to move at the very own pace, so you can vacate our home and get away from the effort regarding de–clutting and you may presenting your current household, in addition to trouble having to cleanse and leave everytime discover a consult to exhibit the home?

The problem is, a lot of property owners won’t be eligible for one another fund and can you prefer to help you make use of the brand new collateral within their latest home to create this fantasy a real possibility.

Many vendors would not take on particularly a beneficial contingent render inside a good seller’s industry such as the one to the audience is currently in. With a bridge financing positioned tends to make your purchase render more desirable, and enable one contend with customers who don’t keeps an excellent where you can find offer.

When you find yourself all of this might sound including an amazing substitute for an excellent brief bucks crisis, this isn’t risk-free. Bridge loans is actually well-known in the sellers avenues when consult exceeds also have, nevertheless should consider multiple points in advance of determining this one try effectively for you.

What is a connection Financing?

To put it simply, a bridge loan links this new gap anywhere between conversion. Homebuyers make use of these short-term fund to invest in their new house if you are awaiting their latest where you can find offer (or in case the new consumer’s present family hasn’t sold before closing).

How can Bridge Funds really works?

Never assume all lenders keeps place direction getting lowest Credit ratings otherwise debt-to-money ratios having connection money. Financial support was guided from the more of an effective does it seem sensible? underwriting strategy. The brand new little bit of the newest mystery that really needs guidance is the long-title capital received towards the new house.

Particular loan providers who make conforming financing ban brand new link loan payment getting qualifying aim. The new borrower is qualified to choose the disperse-right up house by the addition of to each other the existing mortgage payment, if any, to their existing home to the brand new homeloan payment towards move-upwards home.

Of a lot lenders be considered the consumer into a couple of repayments because most buyers enjoys present first mortgage loans to their establish residential property. The customer will most likely close on the move-right up house buy ahead of offering a preexisting house, and so the visitors tend to very own a few residential property, but we hope only for a short time.

Not all bank bundles a bridge mortgage in the same manner. With regards to these loans, what’s important is whether they generate feel towards person’s specific goals and requirements. But not, there are two popular alternatives loan providers fool around with with customers.

The first alternative, a loan provider will bring finance one equivalent the essential difference between to 80% of your own customer’s family value as well as their newest loan equilibrium. The following mortgage goes towards advance payment to the second domestic, once the first mortgage remains a similar before home carries while the mortgage is paid off.

Another choice, people remove that financing for 80% of its home’s well worth. Thereupon currency, they pay-off the first-mortgage. The cash with the next mortgage try after that put on the brand new advance payment to your new house.

Professionals & Cons of Connection Fund

Just as in any financing, discover pros and cons. The main benefit of a connection financing would be the fact buyers normally installed a contingency-free promote for the another type of domestic, instead selling its current one to. This means customers don’t have to hold off to acquire its fantasy household up to its dated you to definitely offers. All things considered, a bridge financing deal a high rate of interest and just continues ranging from six months in order to annually. As well as when your domestic doesn’t sell during that time, you will have to pay off your loan (even though a choice here would be to sell to an iBuyer and you will Trade-In your Central Ohio House). You also have so you’re able to qualify for several residential property and start to become able to pay for several mortgage repayments immediately.

Average Costs for Link Financing

Rates are very different among lenders and you can metropolises, and you can interest levels normally vary. Including, a connection loan might hold no money with the very first four days, but interest commonly accrue and come owed when the loan is actually paid through to profit of the home. Fees and additionally are very different anywhere between loan providers.

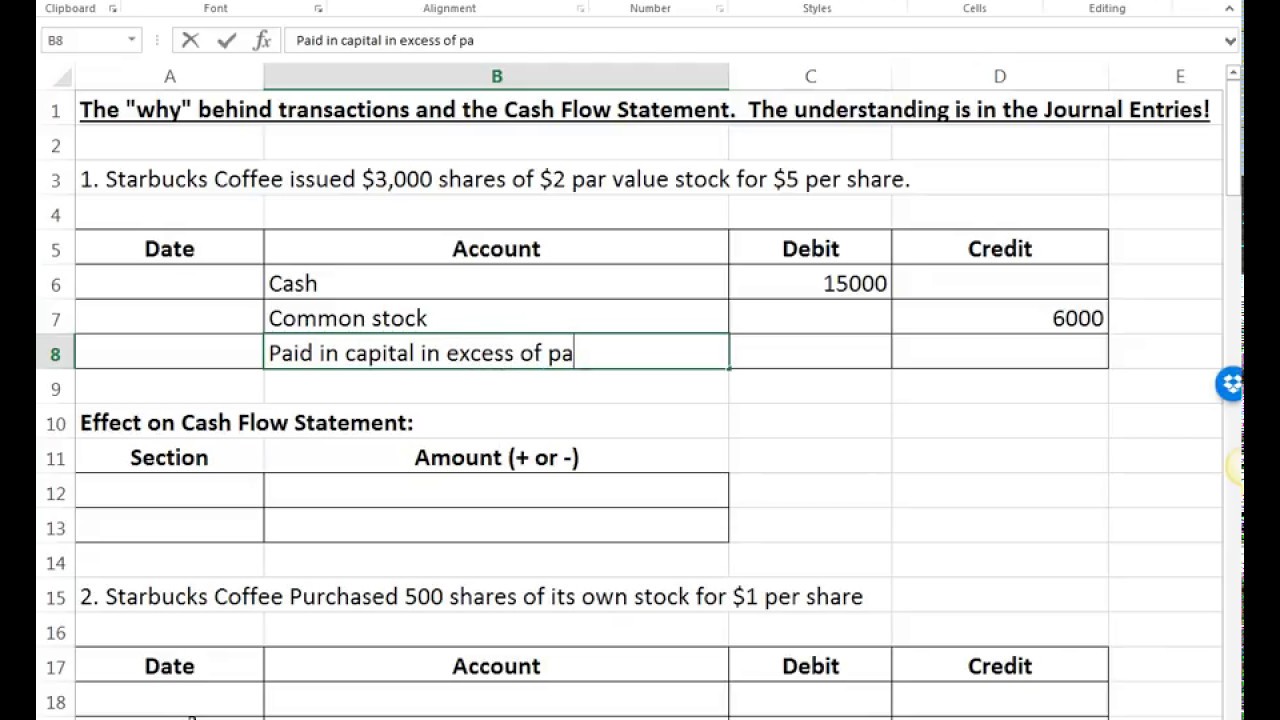

Here are some take to charges predicated on a $ten,000 financing. The brand new administration commission is 8.5% and assessment payment is actually 4.75%. Specific costs could well be recharged in the a higher level than the others.

- Management percentage: $850

- Assessment payment: $475

- Escrow fee: $450

- Title rules payment: $450+

- Wires Costs: $75

- Notary payment: $40

There’s also generally financing origination percentage to your bridge funds. The purchase price will be based upon the level of the mortgage, with every part of your own origination fee comparable to step one% of your own amount borrowed.

Fundamentally, a home security loan is actually less expensive than a link mortgage, however, bridge fund provide far more masters for almost all consumers. On top of that, of several loan providers would not lend towards a home equity loan if for example the home is in the industry.

** Interested in learning on a no cost method which can indeed help the rate at which your residence sells, in addition to buck well worth all of our buyer’s net regarding income? (when you find yourself enabling you to to get a property to find one which just promote, otherwise steering clear of the have to move into brief houses) E mail us today at to own information that technique is one i reserve simply for our very own customers!

The conclusion

Without having the money plus present house have not sold, you could potentially fund the latest down-payment towards disperse-upwards household in just one of several preferred means. Earliest, you could potentially finance a bridge financing. Second, you can pull out property collateral loan otherwise domestic equity personal line of credit.

In any event, it would be safer and work out significantly more financial feel to wait before buying a home. Promote your current household very first. Ask yourself exacltly what the next step is in case the established home will not sell for quite some time. You are financially support two homes.

If you are sure your residence will actually sell, or you keeps a plan positioned but if it generally does not, the main advantage of a bridge financing would be the fact it permits you to definitely stop a great contingent render such as, I am going to buy your family in the event the my family offers.

For many who, otherwise someone you know are considering Buying or selling a home within the Columbus, Kansas please contact The brand payday loan Dover new Opland Classification. We provide top-notch home information and look toward providing you accomplish the real estate needs!

Deja un comentario