Closing costs getting FHA finance generally speaking range between 2% so you can 6% of one’s amount borrowed and include appraisal, credit file, loans Eckley origination charges, lawyer charges, label insurance, inspections, tape costs, and you will upfront mortgage cost. Vendors can contribute as much as 6% of these will set you back.

To apply for an enthusiastic FHA loan since an initial-date client , you can find basic steps you’re able to do inside the buy order your dream family. Let us check:

- Look at eligibility earliest, you ought to be sure to meet the basic conditions and therefore i in depth before. This consists of meeting brand new requirements to possess credit history, DTI ratio, work history, no. 1 residence, no delinquencies.

- Prepare yourself files to prove to the lender plus the Federal Casing Management your in fact conference these types of criteria, you should prepare the files called for pay stubs, financial statements, W-dos models, federal tax returns, etcetera.

- Pick an FHA-acknowledged lender second, pick an FHA-approved bank including Squirt Head Home loan . Selecting the most appropriate lender is extremely important to possess a publicity-100 % free property procedure, this is why we send unrivaled customer service.

- Rating an effective pre-approval upfront seeking your property, definitely get an effective pre-recognition out of your lender of choice. This provides your a sense of just how much you can acquire, and suggests sellers you have major motives about to acquire.

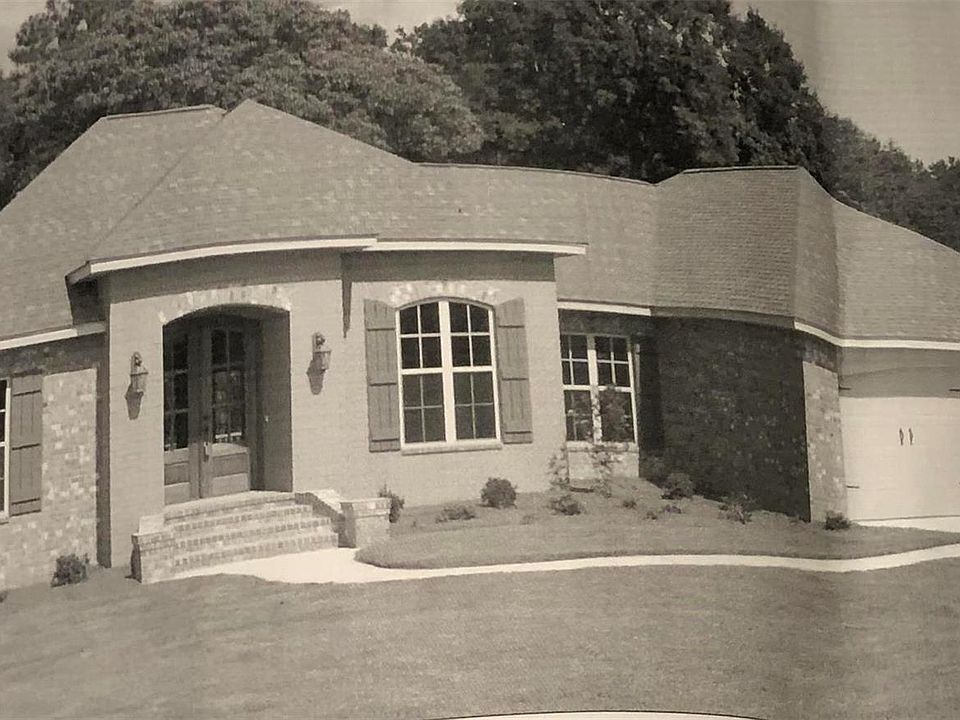

- Get a hold of a home right here will come the enjoyment area finding your dream assets! Discover a property that suits your budget, including matches brand new FHA possessions criteria that we talked about in the past throughout the blog post.

- Make an application for a loan today, it is the right time to get brand new FHA loan throughout your picked lender. Just be ready to provide every expected papers. With Spray Head Financial, you could implement effortlessly and easily here .

- Read appraisal the house requires an enthusiastic FHA-compliant assessment to evaluate its really worth and you can position.

- Watch for acceptance once you have recorded all the details and you may records, the financial institution usually comment your application, make certain your financial condition, and you may manage borrowing from the bank monitors. Once approved, you’ll personal the loan and you may undertake the loan. And you’re ready to relocate!

What is going to disqualify you from a keen FHA loan?

Disqualifiers to own an enthusiastic FHA loan tend to be a credit score below five hundred, a top financial obligation-to-money ratio (more than fifty% more often than not), a track record of personal bankruptcy (in the place of fulfilling wishing periods), a foreclosures over the past three years, and you may an eye on unpaid government bills or tax liens.

Ought i be eligible for an FHA loan having a low credit rating?

Sure, it’s possible to qualify for an enthusiastic FHA mortgage having a reduced credit history. Minimal required rating towards the restriction capital is typically 580. To possess ratings between five-hundred and you will 579, you might still be considered however with a high down payment.

Yes, you can aquire an enthusiastic FHA mortgage even although you aren’t a primary-big date homebuyer. FHA money are around for any licensed visitors which matches new qualification requirements, and additionally credit rating, income, debt-to-earnings ratio, together with property appointment FHA requirements.

What assets items are eligible getting FHA fund?

Eligible assets items for FHA money become unmarried-relatives property, 2-cuatro unit services, HUD-acknowledged condos, and are created homes you to fulfill FHA criteria. The house should be the borrower’s no. 1 quarters and you may meet particular health and safety recommendations.

Experienced Head Performing Manager which have good 20 + 12 months showed reputation for in new banking globe. Skilled in all aspects of one’s home-based financial ent professional with a good Bachelor away from Research (BS) centered operating Government and you will Management, out-of St. Joseph School. An immediate acceptance underwriter and you may an authorized Real estate loan Founder.

Deja un comentario