(Bloomberg) — At first glance, Charles Schwab Corp. getting swept up on worst All of us banking drama as 2008 can make absolutely nothing sense.

The business, a 1 / 2-century pillar from the brokerage business, isn’t overexposed so you’re able to crypto such as for instance Silvergate Resource and Signature Lender, nor in order to startups and you will venture capital, hence felled Silicone polymer Area Lender. Less than 20% off Schwab’s depositors go beyond new FDIC’s $250,000 insurance cover, compared with on ninety% at the SVB. In accordance with 34 million levels, a good phalanx regarding financial advisors and more than $eight trillion away from assets across each of the organizations, it towers more local organizations.

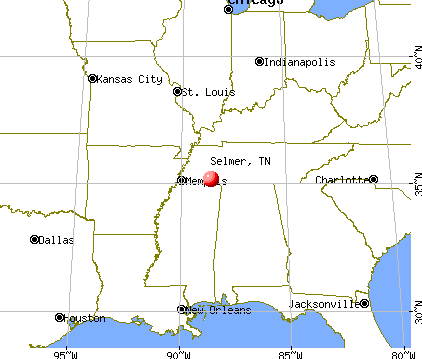

As an alternative, since crisis drags with the, people are beginning so you can uncover risks that have been hiding within the ordinary vision. Unrealized loss to the Westlake, Texas-established firm’s balance sheet, laden with a lot of time-old bonds, ballooned to more $31 mil last year. At the same time, large interest rates is promising consumers to go their money away from certain accounts you to underpin Schwab’s team and you may reinforce the base line.

Its a different sort of indication that Federal Reserve’s fast policy tightening trapped this new financial business flat-footed immediately after many years off decreasing prices. Schwab shares have forfeit more than one fourth of the worth because the February 8, which includes Wall surface Road analysts pregnant earnings so you’re able to sustain.

Chief executive officer Walt Bettinger additionally the brokerage’s inventor and namesake, millionaire Charles Schwab, said the company is actually match and you may willing to endure the fresh greater turmoil.

The company was misunderstood, and it’s really misleading to target papers losings, that your providers could possibly get never need to happen, it said a week ago in an announcement.

There is enough exchangeability immediately so you’re able to safeguards if the 100% of our own bank’s places ran regarding, Bettinger told the new Wall surface Roadway Record in the a job interview published Thursday, incorporating that agency you certainly will obtain in the Government Home loan Bank and you can point permits from put to address one money shortfall.

Because of an agent, Bettinger rejected blog link to comment for this facts. An effective Schwab representative rejected so you’re able to review outside of the Thursday declaration.

The fresh wider drama presented signs of easing on the Tuesday, just after Basic Citizens BancShares Inc. accessible to purchase SVB, buoying offers regarding this really is along with Schwab, which had been upwards step three.1% at 2:29 p.meters. into the New york. The fresh new inventory continues to be down 42% from its top in the , 1 month before Fed been raising rates.

Unusual Operation

Schwab try strange certainly one of peers. It works one of the primary Us banking companies, grafted on to the most significant in public replaced broker. Each other departments is actually sensitive to interest-price action.

Instance SVB, Schwab gobbled right up offered-old securities within lower output for the 2020 and you can 2021. That implied paper losses climbed inside a short period since Fed began boosting rates in order to stamp away rising prices.

3 years back, Schwab’s chief financial didn’t come with unrealized losses toward long-title obligations this desired to keep up until maturity. Because of the last March, the firm had more $5 billion of these papers losses – a statistic one to climbed so you’re able to more $thirteen million on year-avoid.

It moved on $189 billion off agency mortgage-recognized bonds out of available-for-sale to help you held-to-maturity to the the harmony layer this past year, a shift one effortlessly protects the individuals unrealized loss out-of impacting stockholder guarantee.

They generally watched high interest rates coming, Stephen Ryan, an accounting professor within New york University’s Strict College from Providers, said inside the a telephone interview. It don’t understand how enough time they’d last otherwise the size of they’d feel, nonetheless they safe the brand new equity by simply making brand new import.

The rules ruling such as harmony layer moves was stringent. This means Schwab plans to keep more than $150 mil value of personal debt to maturity having a beneficial adjusted-mediocre give of 1.74%. The latest lion’s express of the ties – $114 billion at the conclusion of 2022 – wouldn’t mature for over ten years.

Dollars Organization

In the cause of Schwab’s earnings are sluggish client currency. The firm sweeps bucks places off broker membership to the financial, where it can reinvest during the higher-producing affairs. The difference between what Schwab brings in and you can exactly what it pays out in the appeal to users are its online appeal income, being among the most crucial metrics to have a financial.

After a-year from easily rising pricing, there’s greater bonus to end are stagnant with dollars. While many currency-market financing are using more than cuatro% notice, Schwab’s sweep profile promote merely 0.45%.

While it’s an open matter just how much currency consumers you’ll get off their sweep vehicle, Schwab’s administration approved it decisions acquired last year.

As a result of quickly expanding quick-identity rates of interest in 2022, the company noticed a rise in the speed from which subscribers gone specific cash stability to your highest-yielding choices, Schwab said with its annual report. As these outflows features proceeded, he’s outpaced an excessive amount of cash on hand and money created by maturities and you may spend-lows toward our financial support portfolios.

FHLB Borrowing

In order to connect new gap, the fresh new brokerage’s banking systems borrowed $several.4 million regarding FHLB program from the stop off 2022, along with the capacity to borrow $68.six mil, based on an annual statement registered that have authorities.

Experts had been weighing such things, that have Barclays Plc and you can Morningstar lowering its price needs getting Schwab shares into the present months.

Bettinger and you will Schwab mentioned that the company’s long history and you can conservatism can assist customers browse the present day stage, because they enjoys for more than 50 years.

I are still confident in our visitors-centric means, the newest results of your business, as well as the much time-name balance of our providers, they blogged when you look at the past week’s report. We’re diverse from almost every other finance companies.

Deja un comentario