If you are searching so you’re able to utilize the residence’s collateral, there are several different options to select from, also a cash-out refinance. Having a cash-away re-finance, a larger home loan tend to change your newest home loan, and you will have the left harmony in the way of dollars.

Why does an earnings-away refinance work?

The newest dollars-away refinance mortgage will allow you to pull away money from your own residence’s security. In some instances, an earnings-out refinance may go all the way to 100 percent out-of loan so you can worthy of. The fresh new refinance pays the mortgage balance, and then the debtor could possibly get qualify for up to 100 % of the home well worth. People count outside of the incentives is issued on borrower in bucks, like a consumer loan.

Imagine if a borrower initial got out a good $137,five hundred mortgage to find property. The benefits has grown so you’re able to $175,000 as of today, which have a home loan balance regarding $125,000 leftover. Within this hypothetical circumstances, the borrower might be entitled to sign up for that loan up to 80 percent of house’s appraised value, that is $140,000. When subtracting the amount which is nevertheless due on established home loan, which is $125,000, a max dollars-out-of $fifteen,000 (perhaps not accounting to own settlement costs) remains.

When you should dollars-aside re-finance

When you yourself have enough guarantee of your house so you can be eligible for an earnings-away refinance, the best time for you to take advantage of a profit-out re-finance is totally your responsibility. While in times in which you you prefer a lot more money to undertake a serious debts, an earnings-aside refinance are a smart solution. Everybody has their reasons for choosing when to dollars-aside re-finance, however, a standard reasoning so you can dollars-aside refinance is to try to buy school. Whether it’s your own university fees or a beneficial child’s, for some group, a cash-out refinance is more financially standard than just a high-focus student loan. Another prominent factor in a finances-aside refinance would be to pay-off costs which can be tied to higher interest levels, such as for example high-desire credit debt. Some body in addition to tend to consider cash-out refinances to look at pricey family solutions or house repair projections. Assuming you have an importance of cash and also as long just like the you may have sufficient guarantee of your house to discover the money you desire to possess a particular debts or pick, just the right time to take out a cash-out refinance are always range between you to definitely borrower to another.

Cash-away re-finance compared to. HELOC

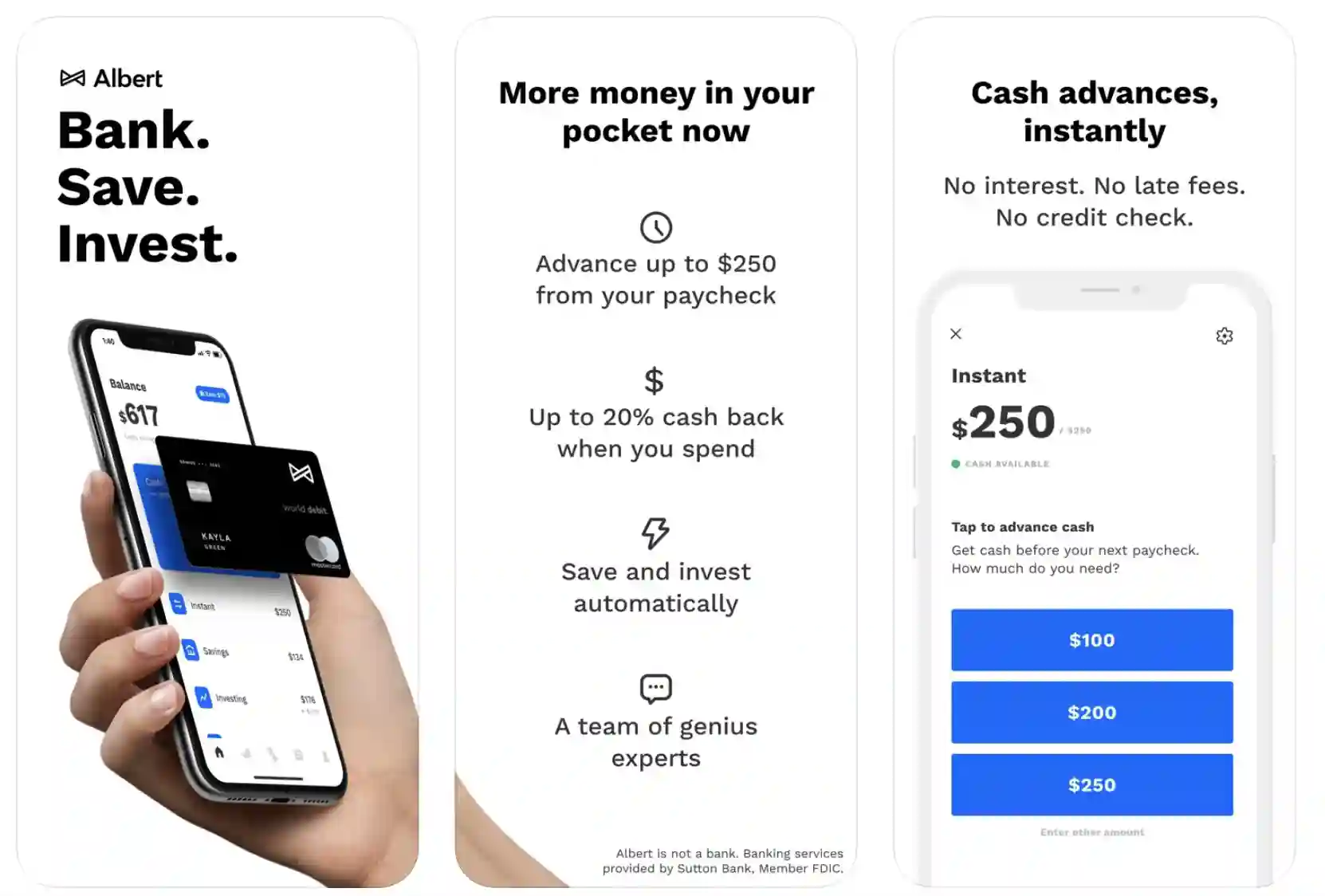

A home Guarantee Credit line (HELOC) could offer an equivalent solution because a funds-away refinance, however they are one or two independent process. If you are looking so you can borrow secured on a few of your property security, not, it’s best so you can $250 loan app carefully mention one another choice when determining which option is most appropriate for your requirements.

Good HELOC will not replace your present home loan otherwise pay it off; its an extra financing, and since it’s considered a second loan, it will have its repayment plan and you can words. A beneficial HELOC typically has a suck period of around ten years, and during this time period, individuals can also be withdraw off their offered borrowing when they are interested. The latest repayment months can start as mark months is over, and you can consumers need pay off the fresh outstanding equilibrium within two decades. It is extremely crucial that you observe that while the draw several months ends up and installment months initiate, individuals are not any expanded permitted withdraw money; its purely a payment several months. The rate to own good HELOC usually usually are very different predicated on the present day markets, regardless if oftentimes, a fixed-speed HELOC may be you can. One to distinguished advantageous asset of good HELOC is that you do not have settlement costs; should you, he is pretty low.

Deja un comentario