Summary

Are you planning to purchase your very first domestic? Home ownership are an aspiration for many individuals, however, so you can convert you to definitely toward reality need work, diligence and you may financial commitment. As a first and initial time domestic visitors you should be a lot more careful and also have a call at-depth comprehension of this new procedure on it.

Trying to find a property means your time and effort, effort and partnership. You need to very carefully consider the choices given your lifestage and you may budgets. Most people pick a house only when within lifestyle, it is therefore extremely essential that you still do it. Our house can be pretty upcoming-research in the sense so it is suffice the needs of your loved ones for years to come with regards to living space, venue along with value.

How big is too large?

There are a number of products that you need to weighing when you are looking at how big is the home. This will believe your financial allowance, what number of family unit members staying in our home now and you can later, the possibility of which have traffic come out to stand, whether or not the home is solely to possess notice-fool around with or you are also to buy they from an investment section out-of consider, an such like. Responding this type of questions create help you decide the right sized the structure.

Floors go up:

Designers will levy a high rate for each and every square foot to possess apartments which happen to be located on highest floor for the a top-increase strengthening. This simply means the rate of your own initial floors flat maybe cheaper than you to definitely with the tenth floors. Corner flats also are sold to possess a paid. Keep this in mind while making a buy.

What type of family?

Today, there is absolutely no scarcity regarding choices during the houses. You can get everything from a little studio flat to an excellent mansion. Try for the type of house which is most suited to help you your needs. Contemplate if you need to find an excellent pre-built assets otherwise a good tailormade you to definitely work for you.

Provide a considered to places:

Modern homes have revolutionised the way some body remember their houses. Today, housing buildings become bundled with facilities eg fitness centers, spas, pools, club home, etc. not, the cost of these https://paydayloansconnecticut.com/jewett-city/ business needs to be borne because of the residents. You should carefully consider the necessity for these types of services and you will if or not they fit into the along with your variety of lifestyle. For instance, when you have young children, after that that have an apartment advanced that have a-game space may be a no-brainer. Do not forget to take into consideration vehicle parking section or garages if you individual auto; you want space in their eyes.

Place is key:

According to your daily schedule, works place and the dependence on a good colleges for your pupils, you need to see a property on correct area. It’s also wise to decide for an area with a medical facility into the the space where you could come in case of scientific emergencies. Many people you desire an effective usage of public transport including the visibility off a beneficial location route close, a bus avoid otherwise a stop. Thought all these facts very carefully when purchasing a property. When choosing the region, also promote a considered to the latest neighbourhood, new building’s area in addition to their foibles. Based your preference, you will need a property when you look at the a quiet neighbourhood or with market close. Similarly some individuals choose a home that have a small yard or greenery within building.

History of the supporter/builder:

It’s important to to consider the fresh profile and you may tune listing of your promoter/builder of the home for which you plan to get your domestic. Find out if the fresh creator gets the reputation of finishing systems during the stipulated go out, quality of structure, getting what might have been guaranteed, an such like.

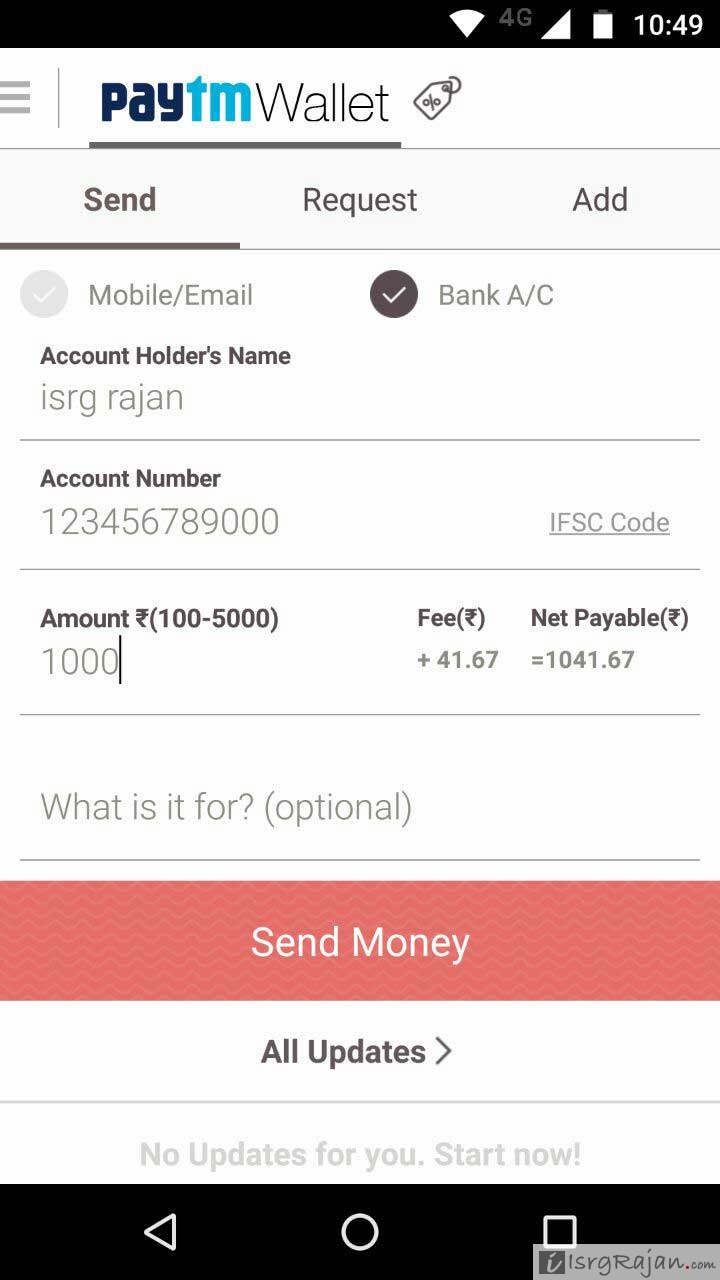

Financial support your house:

To buy your dream house, you need money. While you could have amassed specific the main financing, you may have to thought bringing a home loan to fund this new pit. Consider bringing home financing out-of a respected construction monetary institution, which supplies fast sanctions and disbursals, a lot of time tenure home loans, levies realistic charge, an such like. Home financing not merely makes it possible to loans your ideal family, you additionally rating tax pros to the desire repayments and prominent money.

Buying your first family need an abundance of think and you may think. Be sure to have a look at from the some tips on this listing to help you stop common issues that an initial time household customer confronts.

Deja un comentario