- Full loan to help you worth of the home (just how much guarantee you’ve got)

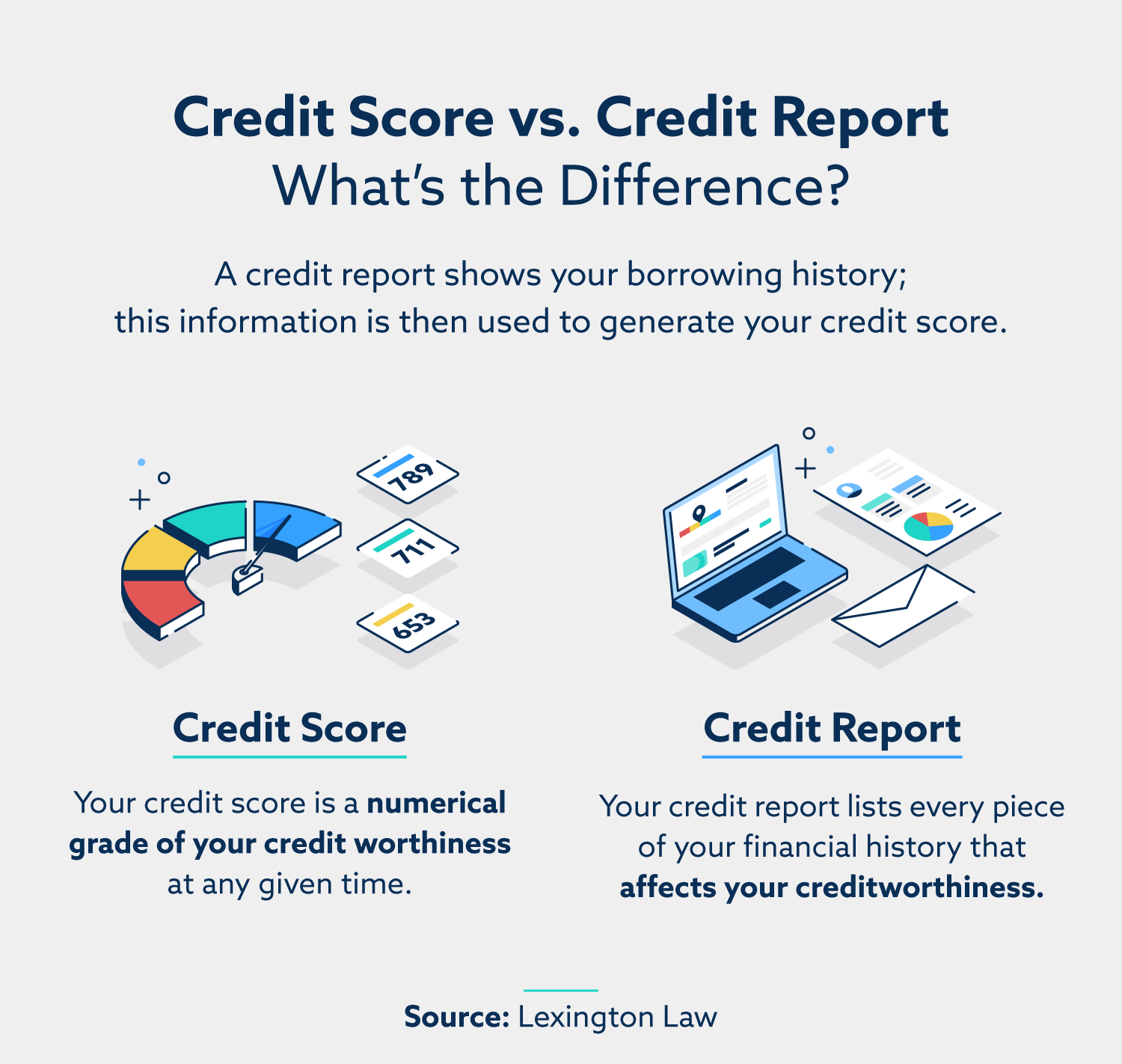

- The credit character

- Your personal items

Homeowner fund, comparable to important mortgages, come in a selection of points. Talking about divided into repaired cost and changeable costs. You might normally plan to simply take possibly a two, step three otherwise 5 season device dependent on exactly what is best suited for the factors.

Specific homeowner loan repaired rates likewise have the benefit of perhaps not that have any early payment fees. This means you can pay off your loan at any area.

Prior to going ahead using this style of mortgage you’ll want to make sure simple fact is that right choice for your. For people who talk to a brokerage you to just offers secured personal loans, up coming obviously that is what you will end up provided. But if you consult with our people during the Chartwell Investment, they are going to look at other available choices one to ple, you might be able to remortgage with a new bank and you will acquire the other funds you want. This might be usually the least expensive answer to boost finance.

An alternative choice that may be better for you are providing out extra credit together with your newest lending company; while you are halfway using a product or service, you may be in a position to increase fund along with your current financial courtesy a further advance, dependent on value, mortgage in order to value and you can credit score. Find all of our publication to the remortgaging to release security.

Yet not, in the event that a homeowner mortgage looks like your best option for you they could come across you the best you to for your needs.

What’s the procedure?

If you are considering a secured citizen loan you will most certainly already feel used to exactly how providing a mortgage work. But with 2nd costs mortgage loans, what is the processes?

- Comparison shop

As we describe over, step one shall be discovering whether a homeowner mortgage is the greatest selection for you and when it is, definitely get the best citizen financing bargain because of the talking to our partners in the Chartwell Investment.

- Choice theoretically

Up coming, if you are happy to go-ahead the next thing is for your adviser to secure your decision in theory. 2nd, same as that have a mortgage, if this is actually covered, their agent usually prepare your application. You’ll want to provide data files just like your lender comments and you may payslips.

- The application would-be felt

After they receive your application the financial institution commonly check the recommendations and you can data you’ve provided. They’ll in addition to show a great valuation of the home to be certain its adequate defense.

- You’ll get a deal

And when the lending company welcomes your application to suit your secure homeowner financing, might give you an offer. They are going to also posting a copy with the representative as well.

- Completion

After you have signed the new paperwork to suit your secure citizen mortgage, you and the financial institution usually program a night out together in order to drawdown the newest currency it is named achievement.

Swinging house with a citizen mortgage

For individuals who promote your home, you’ll want to pay your next costs mortgage except if the fresh new bank makes you transfer the next home loan to a different possessions.

Great things about homeowner funds

Such mortgage is very good for property owners who will be not able to stretch the current financial, otherwise in which that isn’t beneficial so they are able take action.

To stop high early repayment charges

If you would like raise financing but they are halfway using your latest home loan label, there could be a young fees costs adjust loan providers https://paydayloansconnecticut.com/bantam/ and you may offer the borrowing from the bank. It could be less expensive to improve new money you would like courtesy a resident financing to cease this new fees and you may after that review the choices once more by the end of your current mortgage offer.

Deja un comentario